Top hints from Joseph Stiglitz’s economic theories for successful steel market investment

3 min read

Top hints from Joseph Stiglitz's economic theories for successful steel market investment

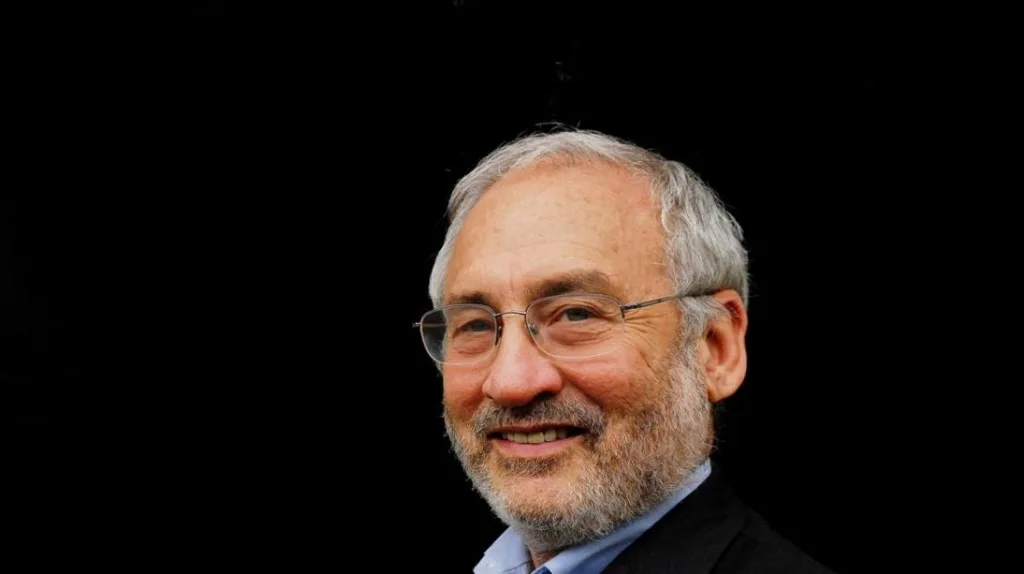

Embark on a journey to investment prosperity with the expert guidance of Joseph Stiglitz, the Nobel laureate whose profound economic theories have reshaped our understanding of markets and investments. In this comprehensive guide, we harness Stiglitz’s acclaimed principles and apply them to the dynamic realm of the steel market, offering strategic advice to optimize investments in steel stocks on global platforms like the London Metal Exchange (LME) and the Hong Kong Stock Exchange (HKEX).

Unveiling Stiglitz’s Economic Wisdom in the Steel Market Context: Joseph Stiglitz’s contributions to economics encompass a wide range of topics, from information asymmetry to market inefficiencies. By delving into Stiglitz’s insights, investors can gain invaluable perspectives on navigating the complexities of the steel market.

- Information Asymmetry: Stiglitz’s seminal work on information asymmetry highlights the challenges posed by unequal access to information in markets. In the steel market, investors should be aware of the potential for asymmetrical information between market participants, such as steel producers, consumers, and regulatory bodies. By conducting thorough research and staying informed about steel market dynamics, investors can mitigate the risks associated with information asymmetry and make more informed investment decisions.

- Market Inefficiencies: Stiglitz’s research on market inefficiencies underscores the presence of distortions and imperfections in market mechanisms. In the steel market, investors should be vigilant in identifying and capitalizing on opportunities arising from market inefficiencies, such as mispriced steel stocks or arbitrage opportunities across different steel exchanges. By leveraging Stiglitz’s insights, investors can exploit market inefficiencies to enhance returns and mitigate risks in the steel market.

Strategies for Strategic Steel Market Investments: Armed with Stiglitz’s economic wisdom, investors can devise strategic approaches to navigate the steel market and optimize returns on steel investments.

- Risk Management: Stiglitz emphasizes the importance of risk management in investment decision-making. In the steel market, investors should diversify their portfolios, spreading investments across different steel companies, geographic regions, and investment instruments. Additionally, consider hedging strategies, such as options or futures contracts, to mitigate exposure to steel price volatility and unexpected market events. By adopting prudent risk management practices, investors can safeguard their investments and enhance long-term returns in the steel market.

- Fundamental Analysis: Stiglitz advocates for rigorous fundamental analysis in evaluating investment opportunities. In the steel market, investors should assess key fundamentals of steel companies, such as financial performance, competitive positioning, and growth prospects. Conduct industry research, monitor steel price trends, and analyze macroeconomic factors influencing steel demand and supply dynamics. By conducting thorough fundamental analysis, investors can identify undervalued steel stocks with strong growth potential and capitalize on long-term investment opportunities in the steel market.

Navigating Global Steel Markets: Global steel markets offer a plethora of investment opportunities for savvy investors seeking exposure to the steel industry’s growth potential. Platforms like the London Metal Exchange (LME) and the Hong Kong Stock Exchange (HKEX) provide avenues to trade steel futures and invest in steel-related equities with transparency and liquidity.

In conclusion, Joseph Stiglitz’s economic insights offer invaluable guidance for investors seeking to navigate the complexities of the steel market. By leveraging information asymmetry, exploiting market inefficiencies, and adopting prudent risk management practices, investors can optimize returns and mitigate risks in the dynamic steel market landscape. Stay informed, stay vigilant, and seize the opportunities that abound in this ever-evolving sector.

This comprehensive guide merges Joseph Stiglitz’s economic principles with practical investment strategies tailored to the steel market, positioning it as an indispensable resource for investors aiming to enhance their knowledge and achieve investment success in the steel industry.